fidelity tax-free bond fund by state 2019

Your Guide to Munis Is Here. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

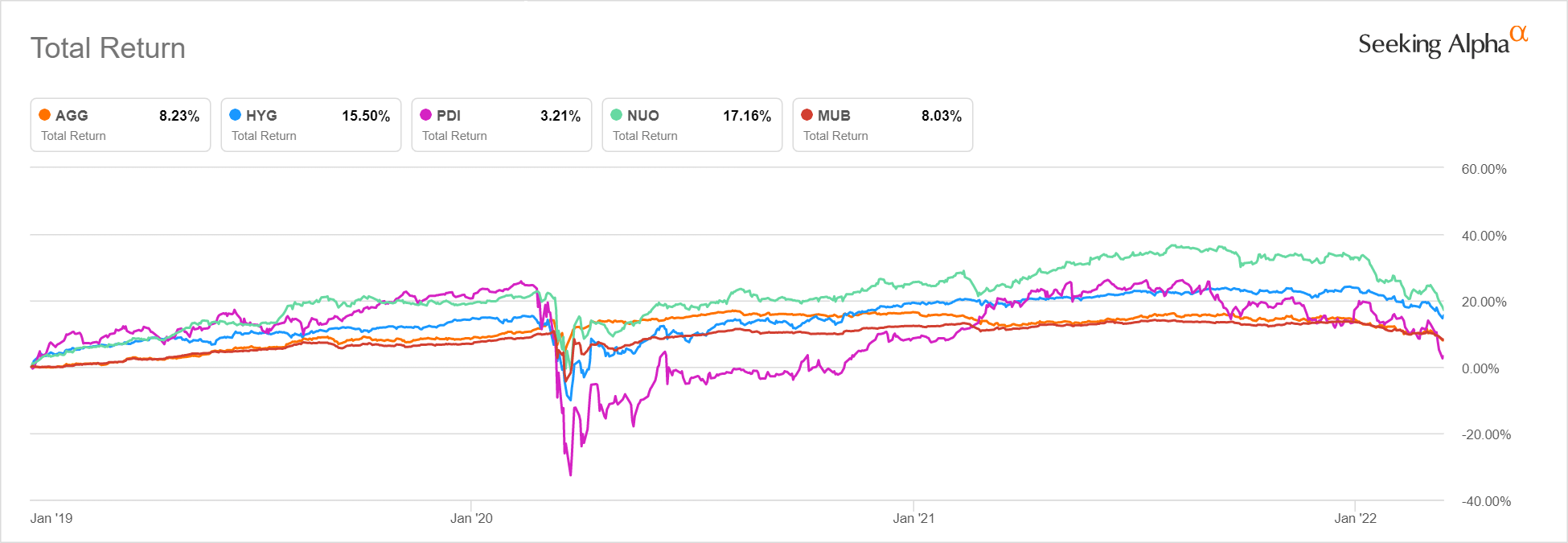

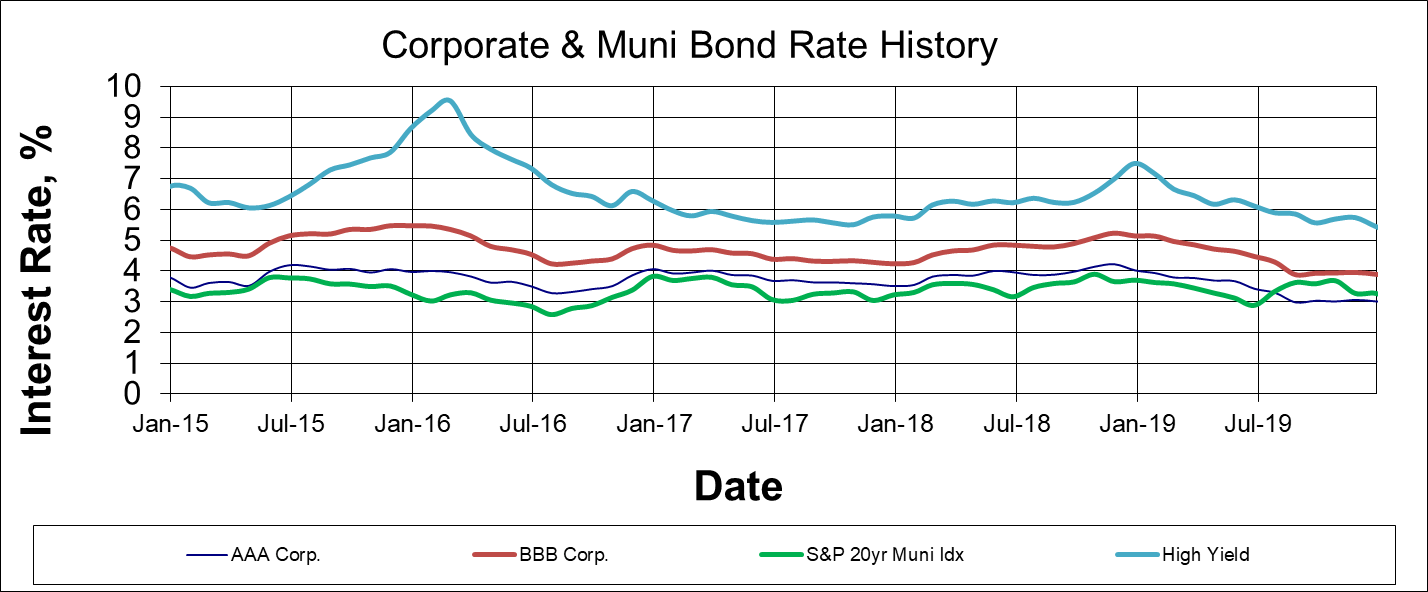

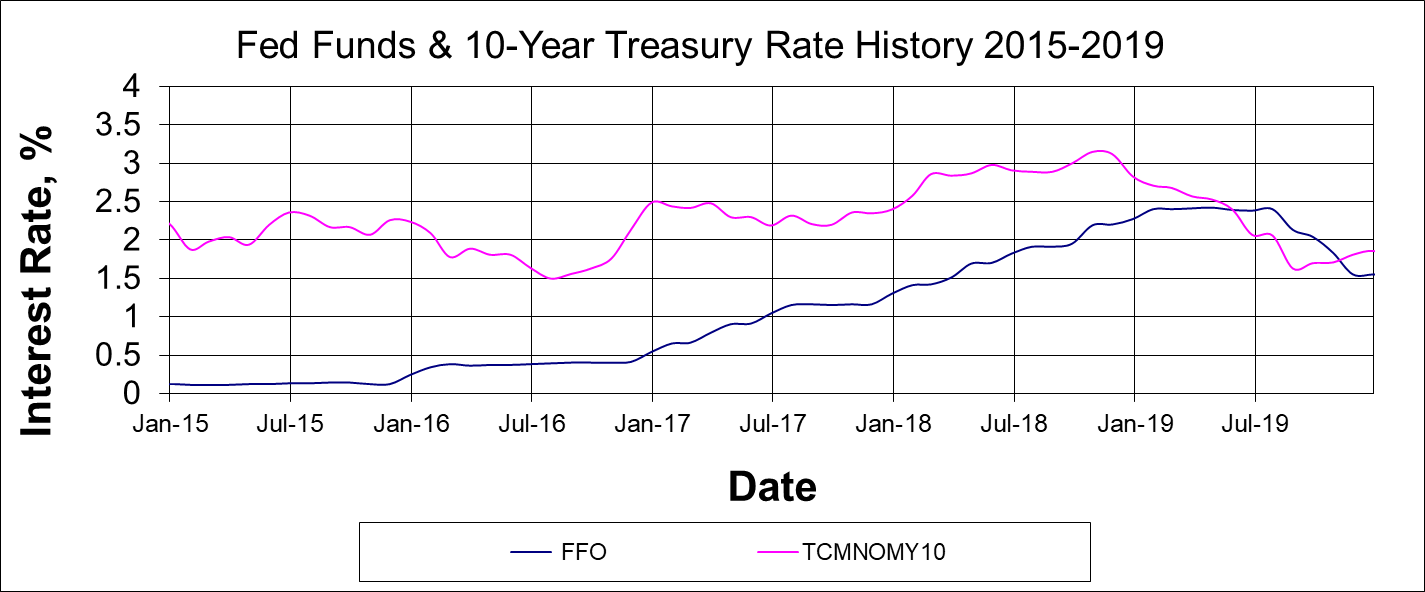

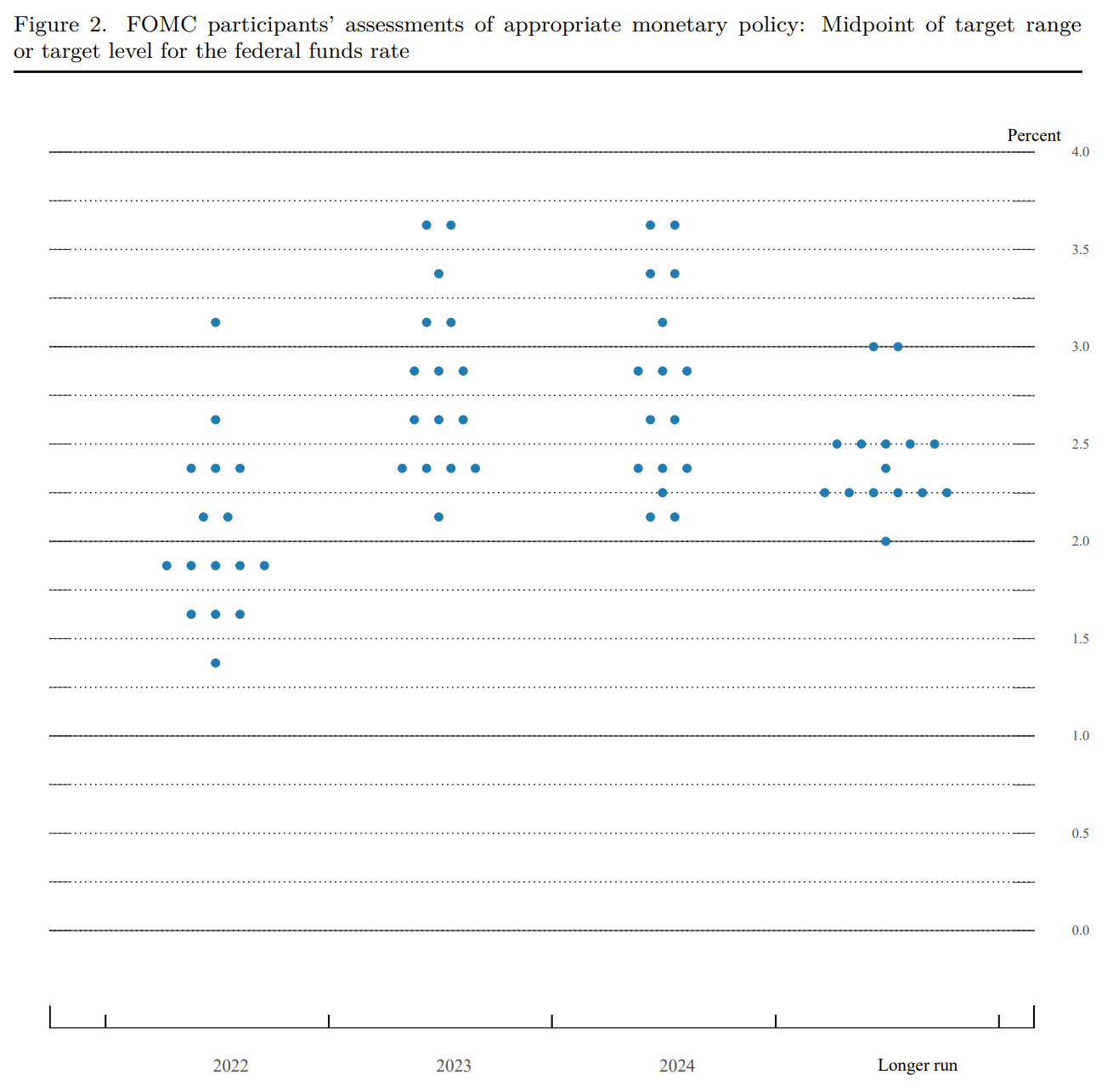

Fixed Income Strategy For A Tightening Monetary Policy Seeking Alpha

Before investing consider the funds investment objectives risks charges and expenses.

. Fidelity Tax-Free Bond has found its stride. To lower risk these portfolios spread their assets across many states and sectors. Your Guide to Munis Is Here.

Ad Learn About The Tax-Exempt Bond Fund of America. The income from these bonds is generally free from federal taxes. To lower risk these portfolios spread their assets across many states and sectors.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. MainStay MacKay Tax Free Bond Fund Class A Load Adjusted-897. Ad Learn About The Tax-Exempt Bond Fund of America.

MUST also trades at a 026 premium to net asset value which means investors pay a tiny premium to the bonds actual worth if purchased now. The 12b-1 fee represents the maximum annual charge deducted from fund assets to pay for distribution and marketing costs. MainStay MacKay Tax Free Bond Fund Class A-468.

Fidelity California Limited Term Tax-Free Bond Fund-408 -362 049 106 130 239 BBg Muni -623 -447 153 252 288 381 BBg MunCA En7YNonAMT -394 -364. Those living within these states may choose to use. Fidelity also offers tax-free municipal bond funds that focus on states such as California New York and Massachusetts.

Because the income from these bonds is generally free from federal taxes and New York state taxes these portfolios are most appealing to residents of New York. Here are seven of the best Fidelity bond funds. Fidelity Tax Free Bond Fund.

Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax. Fidelity Tax-Free Bond Fund ticker. Income that may be exempt from your.

Total 12b-1 fees excluding loads are capped at. Best tax-free municipal bond. Fidelity calculates and reports the portion of tax-exempt interest dividend.

All Classes Alabama 189 014 174 248 Alaska. Fidelity Ohio Municipal Money Market Fund. Click here for Fidelity Advisor mutual fund information.

Fidelity Tax-Free Bond Fund FTABX Fidelity Municipal Income 2023 Fund FCHPX Fidelity Tax-Exempt Money Market Fund. Normally not investing in municipal. Fidelity SAI Tax-Free Bond Fund.

As of April 22 2022 the fund has assets totaling almost 383 billion invested in 1305 different holdings. FTABX FTABX invests primarily in investment-grade municipal securities with interest. QUARTERLY FUND REVIEW AS OF MARCH 31 2022 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified national.

The income from these bonds is generally free from federal taxes.

Almost 3 Trillion Vanishes From Negative Yielding Bond Universe Bnn Bloomberg

Bond Fund Ave Maria Mutual Funds

Fixed Income Strategy For A Tightening Monetary Policy Seeking Alpha

/dotdash_INV-final-10-Year-Treasury-Note-June-2021-01-79276d128fa04194842dad288a24f6ef.jpg)

10 Year Treasury Note Definition

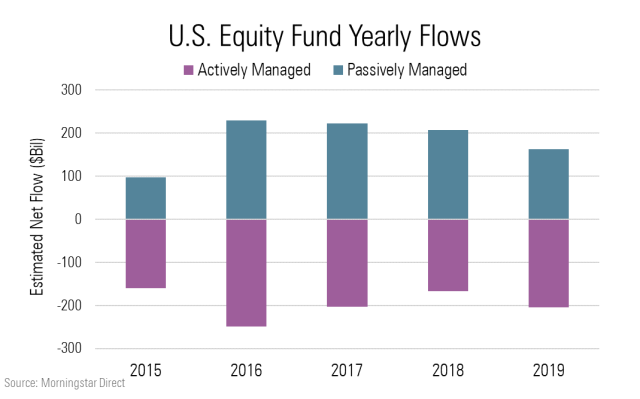

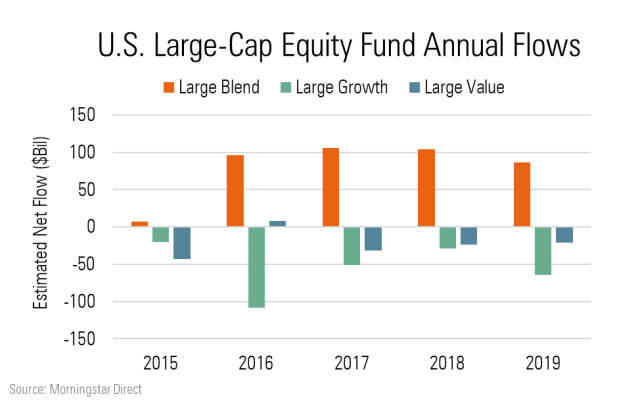

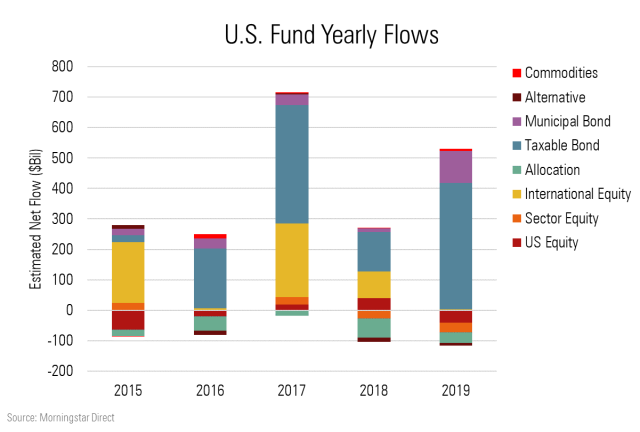

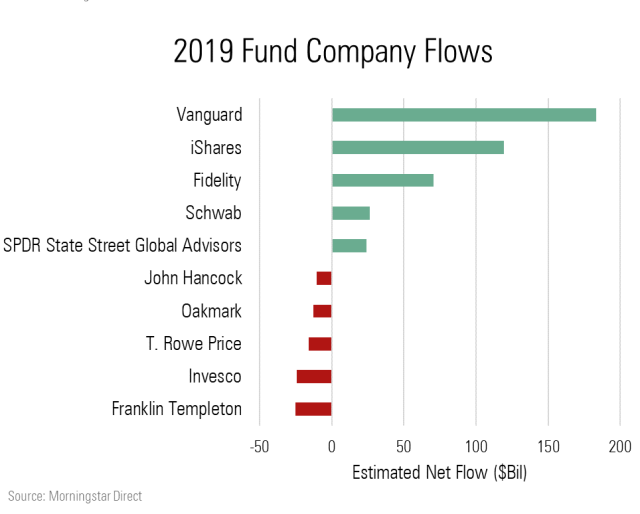

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Bond Funds Fund Management

Q4 2021 Fixed Income Perspectives Video Video Fidelity Institutional

Fixed Income Strategy For A Tightening Monetary Policy Seeking Alpha

Capital Group S Superlatives And Challenges Morningstar

Best U S Taxable Bond Funds Best Mutual Funds Awards 2022 Investor S Business Daily

Fixed Income Strategy For A Tightening Monetary Policy Seeking Alpha

Jewish Communal Fund 2019 Annual Report Donor Advised Funds By Jewish Communal Fund Issuu